The Saudi Central Bank (SAMA) has prohibited the use of instant messaging apps like WhatsApp for customer communication, citing security concerns and deeming them unreliable channels.

This decision is based on SAMA’s regulatory authority and related laws, aiming to enhance best practices among financial institutions under its supervision while mitigating risks.

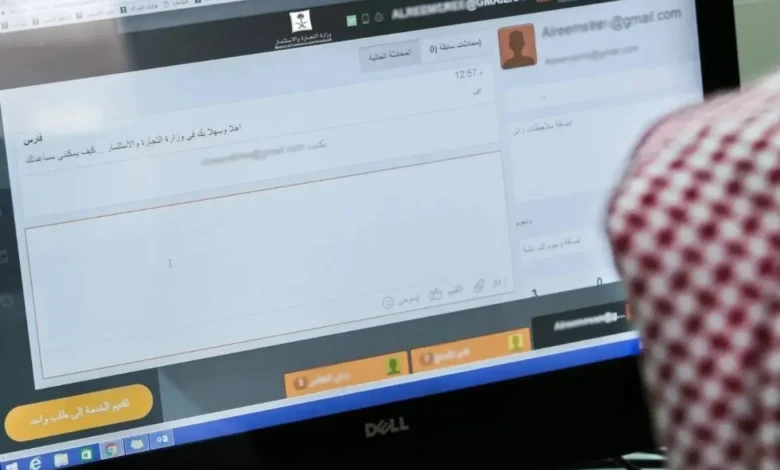

According to information made available to Asharq Al-Awsat, SAMA has directed financial institutions to explore secure alternative communication channels, such as integrating live chat or chatbot services within their official mobile apps or websites. These measures must also comply with personal data protection regulations.

Recently, the Banking Media and Awareness Committee of Saudi Banks warned against individuals fraudulently impersonating charitable organizations or public figures on social media, falsely offering financial aid. These deceptive actors use counterfeit documents and seals to mislead victims into paying fees in exchange for alleged assistance.

The committee highlighted various fraudulent tactics, including individuals posing as representatives of reputable charities or influential figures offering financial support. Victims are often pressured to make payments via bank transfers or fake payment links under the pretense of processing fees.

Reema Al-Qahtani, Head of Fraud Prevention at Arab National Bank, stressed that no legitimate entity requires fees, beneficiary additions, or bill payments to receive donations.

Similarly, Secretary-General of the Banking Media and Awareness Committee Rabiah Al-Shumaisi advised against engaging with any party requesting payments for donations or services, noting an increase in such fraudulent schemes.

For official bill payments and service fees, customers are encouraged to use SADAD, a secure payment system available across all Saudi banking apps.

In case of financial fraud, victims should immediately report incidents to their bank to initiate recovery procedures.