By Ole S. Hansen, Head of Commodity at Saxo Bank

Commodities were traded with a softer bias this week as the focus continued to rest on global macro-economic developments, in some cases reducing the impact of otherwise supportive micro developments, such as the fall in inventories seen across several individual commodities. The dollar found renewed strength and bond yields rose while the month-long bear-market bounce across US stocks showed signs of running out of steam.

The trigger being comments from Federal Reserve officials reiterating their resolve to continue hiking rates until inflation eases back to their yet-to-be revised higher long-term target of around 2%. Those comments put to rest expectations that a string of recent weak economic data would encourage the Fed to reduce the projected pace of future rate hikes.

The result of these developments being an elevated risk of a global economic slowdown gathering pace as the battle against inflation remains far from won, not least considering the risk of persistent high energy prices, from gasoline and diesel to coal and especially gas. A clear sign that the battle between macro and micro developments continues, the result of which is likely to be a prolonged period of uncertainty with regards to the short- and medium-term outlook.

Overall, however, these developments do not alter our long-term views about commodities and their ability to move higher over time. In my quarterly webinar, held earlier this week, I highlighted some of the reasons why we see the so-called old economy, or tangible assets, performing well over the coming years, driven by underinvestment, urbanization, green transformation, sanctions on Russia and deglobalization.

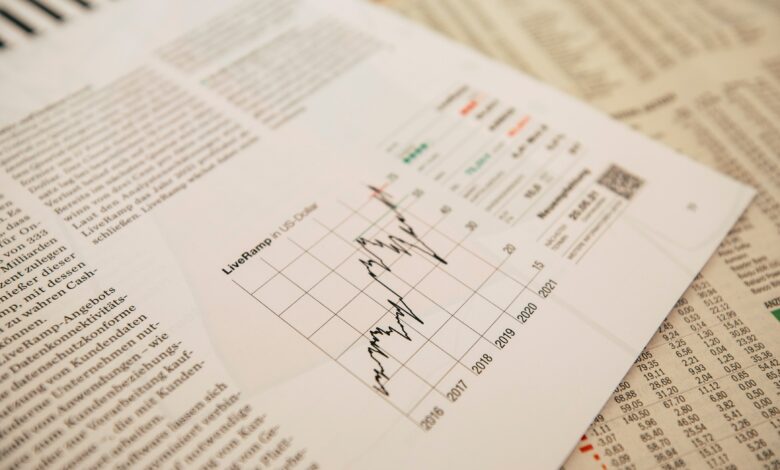

Returning to this past week’s performance, we find the 2.3% drop in the Bloomberg Commodity Index, seen above, being in line with the rise in the dollar where gains were recorded against all the ten currencies, including the Chinese renminbi, represented in the index. It is worth noting that EU TTF gas and power prices, which jumped around 23% and 20% respectively, and Paris Milling wheat, which slumped, are not members of the mentioned commodity index.

Overall gains in energy led by the refined products of diesel and US natural gas were more than offset by losses across the other sectors, most notably grains led by the slump in global wheat prices and precious metals which took a hit from the mentioned dollar and yield rise.

Combating inflation and its impact on growth remains top of mind

Apart from China’s slowing growth outlook due to its zero-Covid policy and housing market crisis hitting industrial metals, the most important driver for commodities recently has been the macro-economic outlook currently being dictated by the way in which central banks around the world have been stepping up efforts to curb runaway inflation by forcing down economic activity through aggressively tightening monetary conditions. This process is ongoing and the longer the process takes to succeed, the bigger the risk of an economic fallout. US inflation expectations in a year have already seen a dramatic slump but despite this the medium- and long-term expectations remain anchored around 3%, still well above the Fed’s 2% target.

Even reaching the 3% level at this point looks challenging, not least considering elevated input costs from energy. Failure to achieve the target remains the biggest short-term risk to commodity prices with higher rates killing growth, while eroding risk appetite as stock markets resume their decline. These developments, however, remain one of the reasons why we find gold and eventually also silver attractive as hedges against a so-called policy mistake.

Global wheat prices tumble

The prospect for a record Russian crop and continued flows of Ukrainian grain together with the stronger dollar helped push prices lower in Paris and Chicago. The recently opened corridor from Ukraine has so far this month seen more than 500,000 tons of crops being shipped, and while it’s still far below the normal pace, it has nevertheless provided some relief at a time where troubled weather has created a mixed picture elsewhere. The Chicago wheat futures contract touched a January low after breaking $7.75/bu support while the Paris Milling (EBMZ2) wheat traded near the lowest since March. With most of the uncertainties driving panic buying back in March now removed, calmer conditions should return with the biggest unknown still the war in Ukraine and with that the country’s ability to produce and export key food commodities from corn and wheat to sunflower oil.

EU gas reaches $73/MMBtu or $415 per barrel of oil equivalent

Natural gas in Europe headed for the longest run of weekly gains this year, intensifying the pain for industries and households, while at the same time increasingly threatening to push economies across the region into recession. The recent jump on top of already elevated prices of gas and power, due to low supplies from Russia, has been driven by an August heatwave raising demand while lowering water levels on the river Rhine. This development has increasingly prevented the safe passage of barges transporting coal, diesel and other essentials, while refineries such as Shell’s Rhineland oil refinery in Germany have been forced to cut production. In addition, half of Europe’s zinc and aluminum smelting capacity has been shut, thereby adding support to these metals at a time the market is worried about the demand outlook.

An abundance of rain and lower temperatures may in the short term remove some of the recent price strength but overall, the coming winter months remain a major worry from a supply perspective. Not least considering the risk of increased competition from Asia for LNG shipments.

Refinery margin jump lends fresh support to crude oil

Crude oil, in a downtrend since June, is showing signs of selling fatigue with the technical outlook turning more price friendly while fresh fundamental developments are adding some support as well. Worries about an economic slowdown driven by China’s troubled handling of Covid outbreaks and its property sector problems as well as rapidly rising interest rates were the main drivers behind the selling since March across other commodity sectors before eventually also catching up with crude oil around the middle of June. Since then, the price of Brent has gone through a $28 dollar top to bottom correction.

While the macro-economic outlook is still challenged, recent developments within the oil market, so-called micro developments, have raised the risk of a rebound. The mentioned energy crisis in Europe continues to strengthen, the result being surging gas prices making fuel-based products increasingly attractive. This gas-to-fuel switch was specifically mentioned by the IEA in their latest update as the reason for raising their 2022 global oil demand growth forecast by 380k barrels per day to 2.1 million barrels per day. Since the report was published, the incentive to switch has increased even more, adding more upward pressure on refinery margins.

While pockets of demand weakness have emerged in recent months, we do not expect these to materially impact on our overall price-supportive outlook. Supply-side uncertainties remain too elevated to ignore, not least considering the soon-to-expire releases of crude oil from US Strategic Reserves and the EU embargo of Russian oil fast approaching. In addition, the previously mentioned increased demand for fuel-based products to replace expensive gas. With this in mind, we maintain our $95 to $115 range forecast for the third quarter.

Gold and silver struggle amid rising dollar and yields

Both metals, especially silver, were heading for a weekly loss after hawkish sounding comments from several FOMC members helped boost the dollar while sending US ten-year bond yields higher towards 3%. It was the lull in both that helped trigger the recovery in recent weeks, and with stock markets having rallied as well during the same time, the demand for gold has mostly been driven by momentum following speculators in the futures market.

The turnaround this past week has, as a result of speculators’ positioning, been driven by the need to reduce bullish bets following a two-week buying spree which lifted the net futures long by 63k lots or 6.3 million ounces, the strongest pace of buying in six months. ETF holdings meanwhile have slumped to a six-month low, an indication that investors, for now, trust the FOMC’s ability to bring down inflation within a relatively short timeframe. An investor having doubts about this should maintain a long position as a hedge against a policy mistake.

Some investors may feel hard done by gold’s negative year-to-date performance in dollars, but taking into account it had to deal with the biggest jump in real yields since 2013 and a surging dollar, its performance, especially for non-dollar investors relative to the losses in bonds and stocks, remains acceptable. In other words, a hedge in gold against a policy mistake or other unforeseen geopolitical events has so far been almost cost free.